Our Proven Process

The SoeFin Proven Process is both straightforward and effective:

1: Discovering your unique circumstances

2: Analyzing your challenges and opportunities

3: Refining your options

4: Determining your solutions

5: Creating your action plan

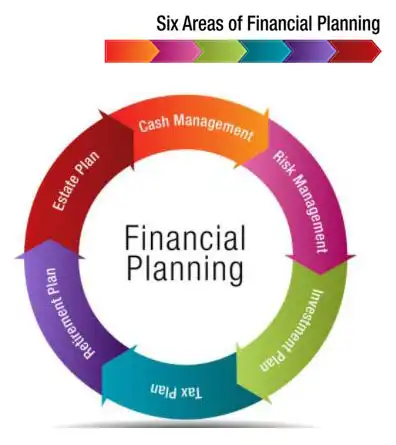

Aligning a client’s goals with their finances is no easy task. No two clients are alike, and thorough financial planning is a team effort, a complex and time-consuming process that can encompass all six key areas of financial planning. We work with our clients to ensure that all their concerns are properly addressed and questions answered, and present the solution in a clear and understandable way.

The Six Key Areas of Financial Planning

How We Meet With Clients

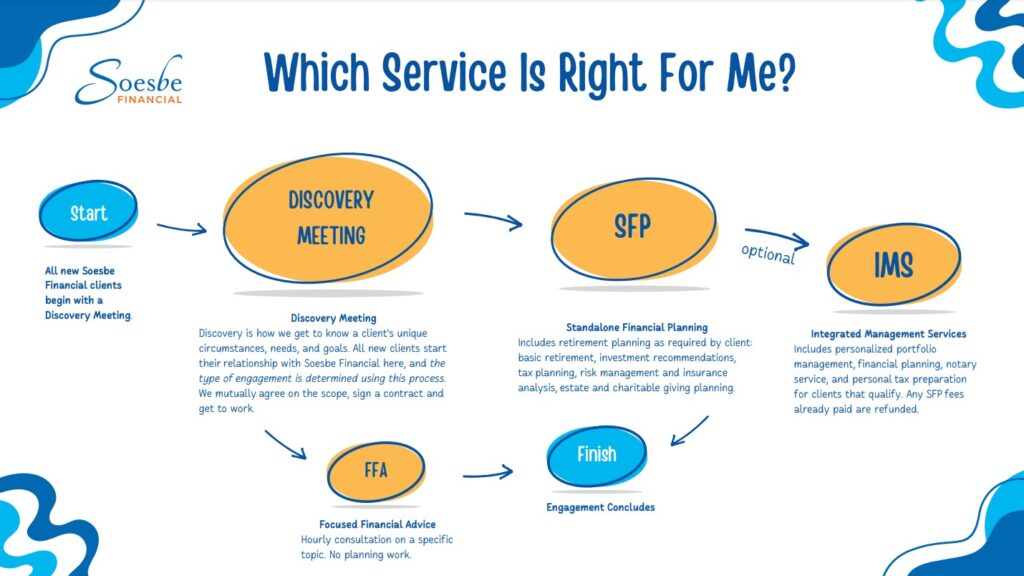

Which Service Is Right For Me?

In-Person or Video?

Six Key Areas of Financial Planning

Financial planning is NOT just about your investments – solid financial planning is about so much more:

1. Income Allocation (improving your financial position): Cash, cash flow, debt and balance sheet management. Where does your money come from and where does it go?

2. Risk Management & Protection: personal, property, casualty and liability risk analysis and management. What risks are you exposed to that could sink your financial ship?

3. Investing for Wealth Accumulation and Distribution: investment goal and gap analysis, risk/reward tradeoffs, risk management including modern portfolio and capital market theories, strategic asset allocation, portfolio stress-testing, and behavioral finance. Saving money for specific goals on purpose and making informed decisions.

4. Tax Management & Planning: strategies to avoid (not evade) current taxes, projection of potential income, property, business and estate tax liabilities, and holistic tax management strategies. Reviewing and understanding your return, and how your choices can impact future years.

5. Retirement Planning: analysis of goals, sources and uses of cash and the respective risks of inflation, longevity, medical needs, taxes and long-term care. Building net worth through systematic savings and investing it wisely.

6. Legacy/Estate Planning: living and loving legacies, challenges, projecting growth of estates, asset titling, trust, and charitable and intergenerational asset transfer techniques. How your estate passes is something in your control.

There are a myriad of options and considerations that must be sorted through and thoroughly examined, compared and evaluated before we can present a plan that is in the client’s true best interests and aligns directly with their goals.

The “No-Robo” in our motto ensures that each client’s individual situation receives our full personal attention. We never put our clients in a box – we do not simply plug people’s assets into a shiny piece of whiz-bang corporate software and let it spit out a prepackaged plan (that coincidentally recommends specific financial products the corporation makes commissions on). That’s not how we do things around here.

We take our time, we get to know our clients and we do it right by systematically applying our considerable expertise to ensure that, when we present a financial plan, it fits your needs correctly.

Our clients often tell us we’ve changed their lives for the better, and we’re pretty proud of that.

How We Meet With Clients

“While most of the hard work goes on behind the scenes, financial planning is very much a team effort between the planner and the client. We respect your time and energy by adhering to proven processes with clear and actionable agendas.”

– Susan Soesbe

For the majority of financial planning clients, an engagement means we will meet three times to work together.

(Please note: every new client, regardless of engagement type, starts with a Discovery Meeting – that’s how we find out what you need!)

Meeting #1: Discovery Meeting

Your Discovery Meeting is an opportunity for us to get to know one another and to explore your unique circumstances, questions and goals. We will sign a client agreement and together take a deep dive into the particulars of your unique situation.

Prior to your meeting, you will receive a Document Checklist. This handy guideline lists the most common documents we will need to review in order to better understand the details of your current situation. If meeting in person, please bring these documents with you to your Discovery Meeting on a flash drive, or as paper copies which we will scan and return to you. If meeting by video, please have these documents ready to screenshare in digital form. After your initial meeting, your planner will give you a checklist of any other specific documents they may require.

NOTE: Please do not use email to share any sensitive information or personal documents. Email as a whole is insecure, and Soesbe Financial cannot guarantee the security and confidentiality of any third-party email provider.

You will also receive a copy of our required disclosure Form ADV 2A Firm Brochure, which provides in-depth information on Soesbe Financial’s qualifications and business practices. Rest assured, you do not need to read this document in its entirety prior to your meeting; it is provided for your reference only. You can access this document online anytime at https://soesbefinancial.com/ADV

Meeting #2: Working Meeting

Your planner now has an excellent grasp of your situation, your challenges, your risk tolerances and your specific financial goals. As the name implies, your Working Meeting is where we get down to the nuts and bolts of things.

Together we will examine all the details, and start to sketch out the big picture as we explore different scenarios and opportunities available to you. Your financial planning engagement is not passive presentations or dry recitation of numbers – you will be an active participant in a lively and engaging process that can bring you financial clarity.

Meeting #3: Plan Presentation

At this point, your planner will have spent many hours behind the scenes, systematically going over every single detail to craft the very best custom financial plan to fit your needs.

During the Plan Presentation, you will walk through the entire plan with your advisor, to ensure all your questions have been answered and nothing has been overlooked.

This is our favorite part. The smiles are amazing.

When your engagement is done, you will have an actionable, comprehensive financial plan customized specifically for you; you will have the documents and files you need to move you confidently to your goal. During the process, you will have absorbed a great deal of new information, so we also make available full recordings of every one of your meetings, which you can use to review everything at your leisure.

Which Service Is Right For Me?

In-Person, or Video?

During the initial Covid lockdown, we started providing video meetings to our clients via our highly secure, enterprise-class business video conferencing platform. The convenience of being able to meet securely with us from the comfort of their own home or office was a huge hit, so we upped our game and decided to offer video meetings as a standard feature to all our financial advice clients.

While in-person meetings do provide a naturally visceral sense of connection, video meetings can make for a relaxed face-to-face environment, and sharing documents is easy using this format.

Yes, we much prefer to meet clients in person (at least for their Discovery Meeting), but we do understand that this is not always possible or convenient, especially for our many clients outside the Sacramento area.

Secure video meetings give you the freedom and flexibility of meeting with us from anywhere your busy life takes you – all you need is a computer with a webcam and internet access.

Choice is good!